Preparing for retirement involves not only accumulating sufficient savings but also devising a strategy to ensure that your income lasts throughout your retirement years. This transition from saving to spending can be complex, and having a reliable income stream is crucial for maintaining your lifestyle, covering healthcare costs, and addressing unforeseen expenses.

Understanding Retirement Income Needs

Assessing Your Income Requirements

The first step in creating a lasting retirement income stream is assessing your financial needs during retirement. Consider the following factors when determining your income requirements:

Monthly Expenses: Develop a detailed budget that outlines your expected monthly expenses, including housing costs, utilities, groceries, transportation, healthcare, insurance, and leisure activities.

Lifestyle Goals: Consider how you want to spend your retirement years. Traveling, pursuing hobbies, and engaging in social activities may require a larger budget.

Inflation: Remember that inflation can erode your purchasing power over time. Ensure your income strategy accounts for rising costs in the future.

Longevity: With increased life expectancy, your retirement savings may need to last for two or three decades. It's crucial to plan for a longer retirement.

Calculating Your Required Income

After assessing your expenses and goals, calculate your required annual income in retirement. A common rule of thumb is to aim for 70 to 80 percent of your pre-retirement income to maintain your standard of living. However, this percentage can vary based on individual circumstances, so it may be beneficial to perform a more precise calculation.

For instance:

- If your current annual income is 75,000 dollars and you expect to need 75 percent of that in retirement, your target would be 56,250 dollars per year.

Components of a Sustainable Retirement Income Stream

To create an income stream that lasts, it is essential to understand the various sources of retirement income available to you. These sources can be broadly categorized into three main categories: guaranteed income, investment income, and supplemental income.

1. Guaranteed Income

Guaranteed income sources provide financial certainty and stability. Common forms include:

Social Security: This government program provides monthly income to retirees based on their earnings history. Consider claiming benefits at full retirement age or deferring to maximize advantages.

Pensions: If you have a defined benefit pension plan from your employer, it may provide guaranteed monthly income during retirement. Understand the terms of your pension and how it integrates with other income sources.

Annuities: An annuity is a contract with an insurance company that guarantees a stream of income in exchange for a lump-sum investment. Consider fixed annuities for predictable income or variable annuities for potential growth tied to market performance.

2. Investment Income

Investment income consists of returns generated from your investment portfolio. This can include:

Dividends: Some stocks and mutual funds pay dividends, providing a regular income stream. Dividend-paying equities can be an excellent addition to your retirement income strategy.

Interest: Bonds and other fixed-income securities generate interest payments. These can offer stability and predictability during retirement.

Capital Gains: Selling investments for a profit can also contribute to your income stream. However, this approach may be less predictable and should be used cautiously.

3. Supplemental Income

Supplemental income sources can help fill any gaps in your retirement income. Options include:

Part-Time Work: Many retirees find part-time work to supplement their income while staying active and social. Consider flexible job opportunities that align with your interests.

Real Estate: Rental properties can provide a steady income stream, but it's essential to consider the responsibilities of property management.

Side Hustles: Monetizing hobbies or skills through freelancing, consulting, or e-commerce can create additional income to support your retirement lifestyle.

Building Your Retirement Income Strategy

Once you have identified your income sources, it's time to create a structured plan for leveraging these assets effectively. Here are strategies for building sustainable retirement income:

1. Develop a Withdrawal Strategy

Your withdrawal strategy dictates how you will draw funds from your retirement accounts and investment portfolio. Consider the following approaches:

The Four Percent Rule: This guideline suggests withdrawing four percent of your retirement savings annually to maintain income while preserving enough capital for growth to last 30 years. Adjustments should be made based on market conditions and individual circumstances.

Bucket Strategy: The bucket strategy involves dividing your investments into buckets based on time horizons and risk levels. Short-term buckets may contain cash or conservative investments for immediate income, while long-term buckets can focus on growth-oriented assets.

Flexible Withdrawals: Consider adjusting your withdrawal amount based on market performance. In years of strong returns, you may withdraw more; in challenging years, reduce your withdrawals to preserve capital.

2. Minimize Taxes on Withdrawals

Tax planning is critical when it comes to retirement income. Different types of accounts are subject to varying tax treatments. Here are some strategies:

Roth Conversions: Converting traditional retirement accounts to Roth IRAs can provide tax-free income during retirement. While you will pay taxes on conversions, withdrawals from a Roth IRA are tax-free.

Tax-Efficient Withdrawals: Withdraw funds from taxable accounts first to allow tax-advantaged accounts (like IRAs) to continue growing. Strategically planning withdrawals can minimize your overall tax burden.

Utilize Tax Deductions and Credits: Ensure you take advantage of eligible tax deductions and credits during retirement to help reduce your tax bill.

3. Focus on Investment Growth

While generating retirement income is essential, it's equally crucial to continue growing your investments. Here are strategies for maintaining growth:

Diversification: A well-diversified portfolio helps manage risk while providing growth potential. Consider a mix of asset classes that align with your risk tolerance and income needs.

Reinvestment: Instead of taking all investment earnings as income, consider reinvesting some earnings back into your portfolio to support growth and offset inflation.

Regular Portfolio Review: Routinely assess your investment strategy and asset allocation to ensure it aligns with your changing needs and market conditions.

4. Prepare for Healthcare Costs

Healthcare costs can significantly impact your retirement budget. Planning for these expenses is essential:

Health Savings Accounts (HSAs): If eligible, contribute to an HSA, which offers tax advantages for medical expenses. These funds can grow tax-free and assist with healthcare costs during retirement.

Long-Term Care Insurance: Consider purchasing long-term care insurance to protect against high costs associated with assisted living or nursing care later in life.

5. Reassess Your Strategy Regularly

Retirement is a dynamic phase of life, and your income strategy may require adjustments. Factors to consider include:

Life Changes: Major life events such as downsizing, health changes, or shifts in your spending habits can impact your income needs.

Market Conditions: Economic fluctuations and market performance can affect investment returns and income generation. Regularly review your portfolio to account for these changes.

Age and Longevity: As you age, your risk tolerance and income needs may evolve. Reassessing your strategy becomes increasingly important to ensure your plan continues to meet your needs.

Common Mistakes to Avoid

While creating your retirement income stream, it's essential to avoid common pitfalls that can derail your plans:

1. Underestimating Longevity Risks

Many individuals fail to account for the possibility of living longer than expected. Build a retirement plan that considers a longer lifespan to prevent running out of funds.

2. Ignoring Inflation

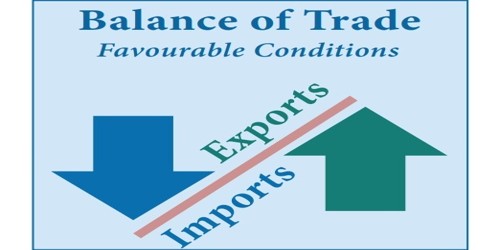

Inflation can erode the purchasing power of your retirement income. Ensure your income strategies, particularly investment growth, are designed to keep pace with inflation.

3. Failing to Diversify Income Sources

Relying on a single income source can leave you vulnerable. Aim to have multiple income streams for added security and flexibility.

4. Withdrawing Too Much Too Soon

Overdrawing from your retirement accounts can jeopardize long-term financial security. Stick to a sustainable withdrawal strategy to preserve your capital.

5. Neglecting Estate Planning

Prepare your estate plan to ensure your wishes are honored and your heirs receive your assets according to your preferences. Consider engaging with an estate planning attorney to assist with this process.

Conclusion

Creating a sustainable retirement income stream is vital to achieving financial independence and maintaining your desired quality of life in retirement. By carefully assessing your income needs, developing a comprehensive strategy that leverages various income sources, and regularly reassessing your plan, you can build a robust income stream that withstands the test of time.

Remember that retirement is not a one-size-fits-all journey. Your personal goals, risk tolerance, and financial situations will shape your unique path to financial security. Stay informed, seek professional guidance when needed, and adjust your strategy to ensure your retirement income lasts throughout your golden years.

Related

-

Financial News

-

Cryptocurrency

-

-

Forex Market

-

Economic Indicators

-

Forex Market